In April the provincial Liberal Government proposed the Ontario Fair Housing legislation, a bundle of measures to make housing fairer and more affordable for Ontario tenants and buyers. Although the proposed legislation – now law related to tenants – will have an Ontario-wide application, the legislation to make housing more affordable for buyers has a narrow application, affecting what is known as the golden horseshoe. The northern boundaries of the golden horseshoe extent to southern Georgian Bay. As a result, the Muskoka and area region is not caught by the new legislation.

Specifically, the new legislation will impose a 15 percent of purchase price tax if the buyer is a “foreign entity”. In other words, if the buyer is not a resident of Canada or a Canadian citizen. There are numerous exemptions, but since the legislation does not apply to buyers and transactions in the Muskoka and area market place, a detailed explanation of these exemptions is beyond the scope of this Report.

The foreign buyers tax has had an immediate and dramatic impact on the Toronto and area market place. Since April 20th when the legislation was announced, sales have dropped by more than 30 percent, and the average sale price today compared to the mid-April high of $949,000 is almost $200,000 less. Since even the highest estimates indicate that only 5 percent of all purchases in the Toronto area market place were by foreign buyers, the new tax should not have had the dramatic impact that it has had. The effect is clearly psychological more than actual, since none of the area’s economic fundaments have changed.

Since the tax does not apply to transactions in the Muskoka and area market place, it should be of little importance, except for the possibility of the psychological spill-over effect seeping into the market place from the lack of market activity in the greater Toronto area.

As of the date of preparation of this Report there is no noticeable impact of the foreign buyer’s tax in the Muskoka and area market place. The main concern for the area is lack of inventory of recreational properties for sale. At the end of June, the Muskoka – Haliburton Association of Realtors had only 766 available recreational listings. This compares with 1187 for the same period last year, a decline of 35 percent. In 2015 there were 1511 active listings.

The situation is similar in all regions. In the Haliburton Highlands listings are down by 35 percent compared to the same period last year (272 to 175). In Lake of Bays the decline is 37 percent (128 to 80) and on Muskoka’s big lakes the decline is a little better at 31 percent (343 to 236). In 2015 the inventory levels were even higher than in 2016.

It comes as no surprise that with declining inventories the pattern of sales is somewhat fractured. Overall sales of recreational properties for the region were up by 3.2 percent compared to June 2016. In May they were up by 12 percent.

Sales on Muskoka’s big lakes were up by 10 percent. In May the year-to-date increase compared to last year was 19 percent. On Lake of Bays sales increased by a stunning 47 percent year-to-date. In May the increase was 45 percent.

For the second month in a row the only region showing a decline in sales is the Haliburton Highlands. In May the year-to-date decline was 10 percent. The market posted a further decline of 9.3 percent in June. Since the Haliburton Highlands region has had the greatest declines in inventory this year, these declines in sale, are probably inventory driven rather than by a lack of demand.

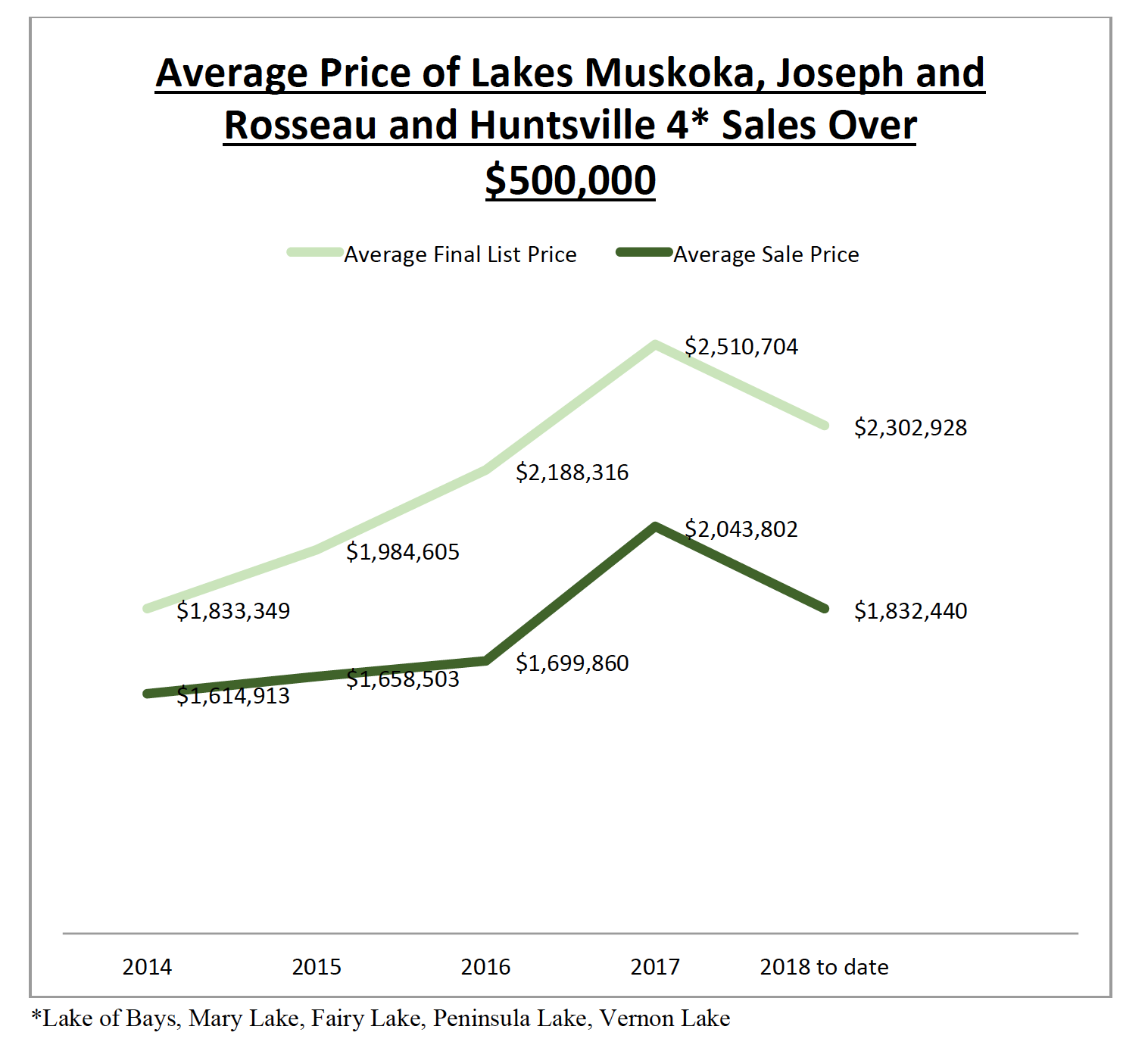

It is not surprising that under theses market circumstances that average sale prices continue to rise. For example, in June the average sale price for all recreational properties reported sold (with a sale price of $500,000 or more) on Lake Rousseau, Lake Joseph and Lake Muskoka, Muskoka’s big lakes, was $2,318,465. This represents a 5 percent increase compared to last June’s average sale price of $2,213,371.

Notwithstanding these declines in inventory Chestnut Park and its sales representatives have outpaced the overall recreational market place. On a year-to-date basis sales are up by more than 7 percent compared to last year, which was the strongest year in the firm’s history, and the dollar volume of sales has increased by more than 27 percent.

For the time-being reduced inventory levels continue to put pressure on buyers, as they are being forced to pay more for desirable recreational properties. A phenomenon normally associated with the Toronto market place, namely multiple buyers bidding for the same property, is now more common in the region. Unless the market becomes impacted by the new provincial tax on foreign buyers, we can anticipate the market place continuing to tighten. At this point it is difficult to foresee what might drive sellers of recreational properties to bring their properties to market. After all, recreational properties are not traded for the same reasons as urban transactions. These sales are discretionary on the part of buyers, and driven by circumstances on the part of Sellers.

Prepared by: Chris Kapches, LLB, President and CEO, Broker

– January-April, 2017

An in-depth look at the Muskoka real estate numbers by the Gardiner Team

Number of Listings and Sales

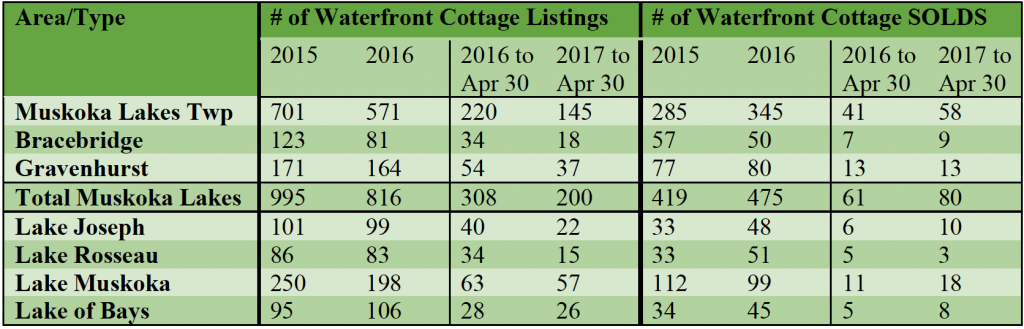

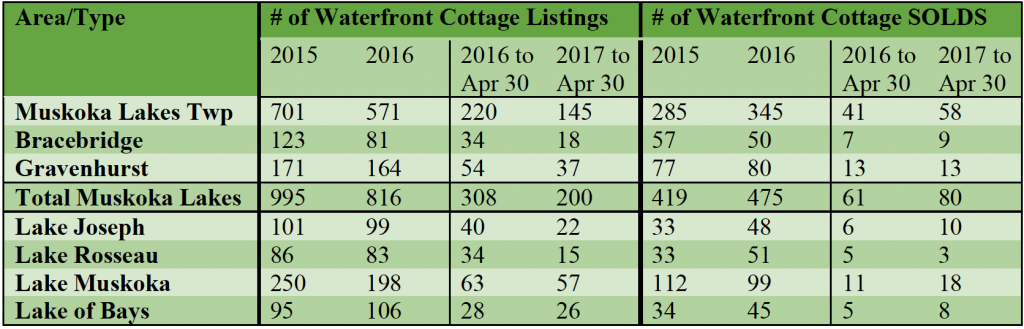

Unit Sales Volume – Summary of Waterfront Cottage MLS® Listings and Sales for the past 2 years, and this year to date as compared to last year to date, by area as reported by The Lakelands Association of REALTORS® and The Parry Sound & Area Association of REALTORS®.

Sales by Price Range

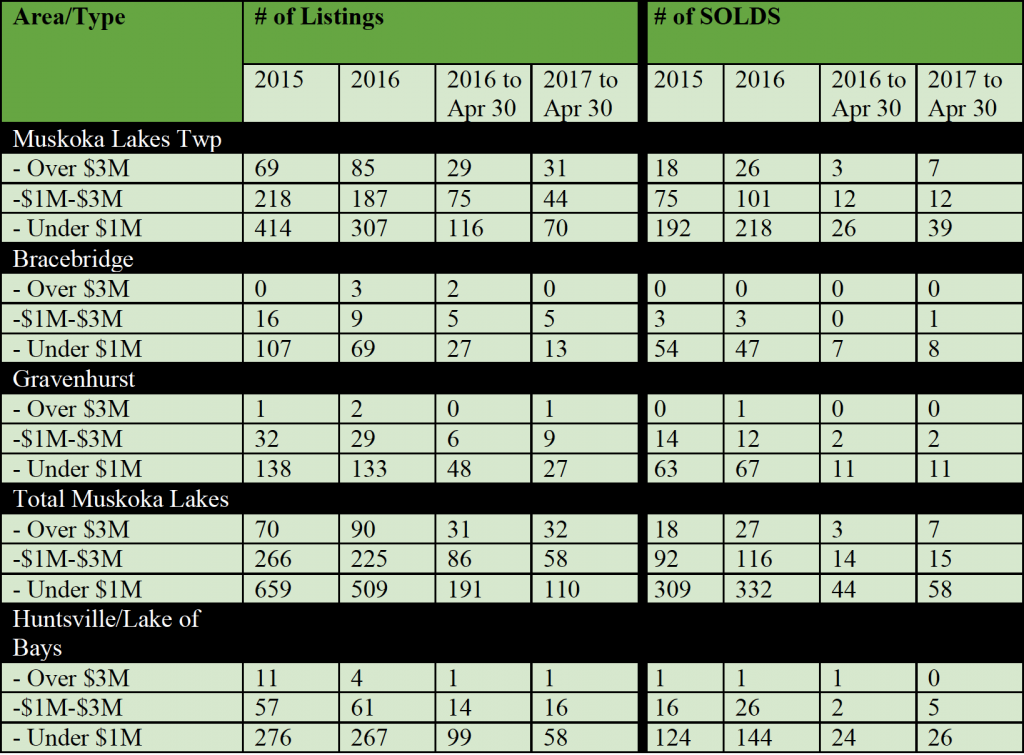

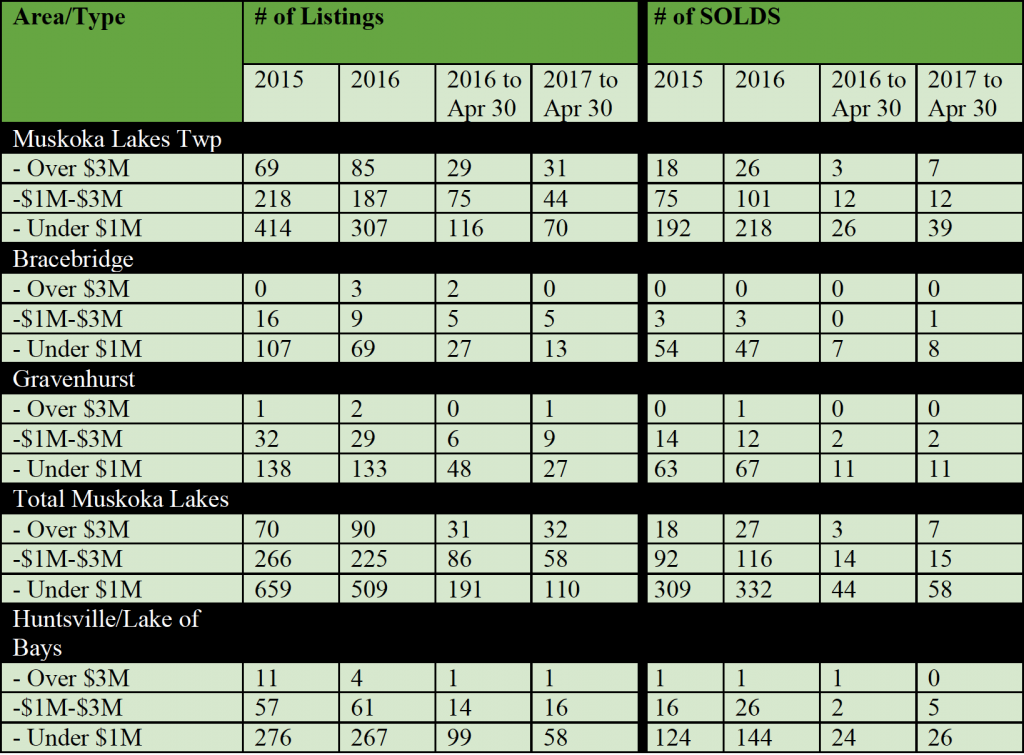

Summary of Waterfront Cottage MLS® Listings and Sales for the past 2 years, and this year to date as compared to last year to date, by area and price range as reported by The Lakelands Association of REALTORS® and The Parry Sound & Area Association of REALTORS®.

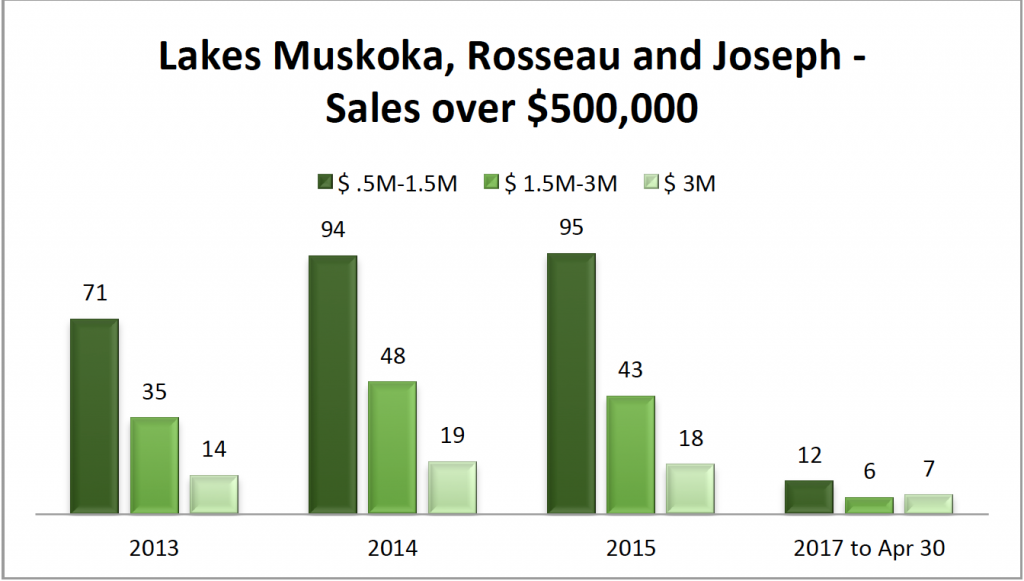

Muskoka Waterfront Cottage Sales by Year and Price Range

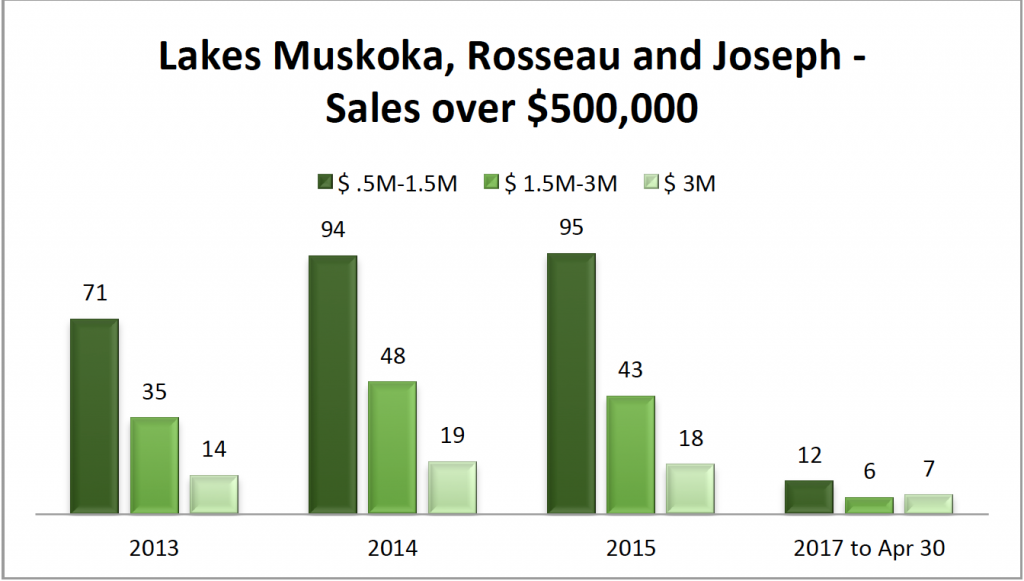

As reported by The Lakelands Association of REALTORS® and The Parry Sound & Area Association of REALTORS®.

How routine are your cottage visits? Do you and your family always do the same thing while you’re there? We want to inspire you to get out of your ‘cottage rut’ and try some new things this year. We have a list from the Chestnut Park Blog that goes outside the typical so you can enjoy yourself and be a little more entertained than normal.

Try this:

1. Wake Up At 6am At Least Three Times During Your Cottage Stay

The best skies are always while you’re still sleeping. Wake up before the sunrise, make your coffee, grab blankets if needed and head down to the dock to enjoy the sunrise. Most cottage regions in Ontario have stunning sunsets, so there’s no reason to avoid them. And hey, you’re at the cottage! It’s not like you can’t have a little dock nap after.

2. Organize A Campfire Jam Session

Round up a few friends, make sure you have a guitar player around, and organize a campfire jam session. Make sure to include a few other instruments such as tambourines, maracas, spoons and others so everyone can join in. Be sure to invite the neighbours and the quiet couple across the lake.

3. Make REVERSE S’mores

Everyone makes S’mores, but considering our post is an attempt to inspire you to switch things up…perhaps you can try switching up your favourite campfire treat? Reverse S’mores are exactly what they say they are but extra delicious. Try the kit

HERE.

4. Try Paddle Boarding

Unless you’re already doing it, paddle boarding is becoming extra popular. If you’re still using your canoe and kayak, it’s time to give something new a try. It’s an excellent work out you can enjoy while vacationing at the cottage, but it’s also a lovely way to enjoy the shoreline peacefully from the water. On hot day, you’ll have easy access to the lake from your paddle board, and getting back on is easier than another watercraft. If you’re not ready to invest in one, there are many places that offer board and paddles for rent.

5. No Cell Phone During Your Stay

Upon arrival, demand that the no-cell-phone-rule is in full effect. Do you think you and your family can handle it? When it comes to taking pictures, have a digital camera on hand and enjoy being at the cottage the traditional way. Not having cell phones around will mean zero distraction and interruptions and full enjoyment of one another’s time…and enjoyment of your surroundings too!

If you are looking for answers to insurance questions for your Muskoka cottage, the best place to start is at a local insurance brokerage. We talked to Lori McCormack at AW Shier Insurance Brokers, now part of the Stan Darling Insurance group. Here are some answers to a few of the most common questions and concerns about waterfront cottage insurance:

Q/ Does it matter if the cottage is occupied year round or only seasonally (May-Oct)?

A/ Cottages that are used year round may qualify for a better price and more coverages than a cottage that is closed up for the winter. A cottage that sits unoccupied for several months is considered to be a higher risk for a loss that may go unnoticed for a longer period of time, which can increase the cost of repairs.

For example, a tree comes down on a cottage causing the interior of the cottage to be open to the elements. The cost to repair would be significantly higher if the loss was not discovered for several months. If you change the occupancy from seasonal to year round or vice versa it is important to advise your insurance broker.

Q/ Why is the distance from the cottage to the closest fire hall important?

A/ Most cottages do not have access to fire hydrants for the fire department to use in the case of a fire. The fire departments in cottage country are typically volunteer based and the distance to the fire hall will determine a rate category for the cottage, either fire hall protected or unprotected. The fire hall distances may vary across companies but typically higher rates are used for properties that are located over 13km from a fire hall, water access only/island, or properties that cannot be accessed during the winter months due to unploughed roads/laneways. Your property may be within the required distance to be rated fire hall protected but if your cottage road or laneway is not accessible during the winter months it will be considered an unprotected property for rating purposes, which means higher rates.

Q/ Why is my cottage insurance more expensive than the insurance for my home in the city?

A/ Here are a few factors that contribute to higher insurance rates for cottages:

The response time for fires is longer in cottage country due to volunteer based fire halls, rural roads, and larger territories. Typically, in cottage country, upon arriving at a fire, the responding fire department attempts to contain the fire from spreading to neighboring properties since the property damage is usually quite extensive. To the insurance company this means a fire at a cottage is usually a total loss.

Cottages are not occupied full time. Variable occupancy is viewed by insurance companies as a higher risk for certain claims such as break-ins, vandalism, and damage caused by animals entering the dwelling.

Q/ Am I covered if I rent out my cottage?

A/ Some insurance companies will not allow rentals, other insurance companies allow rentals with some stipulations. When you rent your cottage you are not only exposing your property to additional risk of loss or damage, you are also exposing yourself to potential expensive lawsuits. For example, you rent your cottage to a family and during the rental a member of their family sustains a permanent disability. If your insurance company was not aware of the cottage rentals, they may deny coverage which means that you would have to hire a lawyer to defend the lawsuit and potentially pay for a settlement as determined by the courts. Talk to your insurance broker about renting your cottage before you start renting. AW Shier Insurance and Stan Darling Insurance offer several cottage insurance packages that allow cottage rentals as well as a commercial package for property owners that are purchasing a cottage for the main purpose of generating rental income.

Q/ Are there optional coverages for cottages that I should consider?

A/ Yes, here are a few optional coverages that you should consider adding to your policy if you don’t already have them:

Vandalism, theft, and burglary – Some basic seasonal cottage packages do not include these coverages.

Building collapse – Providing coverage should the buildings on your property collapse due to the weight of snow.

Bears – Should one of these get into your cottage the damage can be extensive. Not all cottages policies automatically cover you for this type of claim.

Sewer Backup – Covers loss or damage caused by the sudden and accidental escape of sewage or water which enters your dwelling from:

(1) Sewer or septic system on your premises

(2) Drain, or sump pump located within your dwelling

Overland Water – Covers loss or damage caused directly or indirectly by overland water including sewer backup damage resulting from overland water. Overland water is defined as water that accumulates upon or submerges land which is usually dry resulting from:

(1) Unusual and rapid accumulation or runoff of surface waters from any source, including torrential rainfall

(2) The rising or breaking out or the overflow of any body of fresh water

Q/ Do you have any tips for preventing a claim at the cottage?

A/ Yes, we do.

(1) Install a monitored alarm system for theft, vandalism, and also changes in temperature and water pressure. Most insurance companies offer a discount for monitored alarm systems which may offset the cost.

(2) Hire a qualified contractor to check on your cottage regularly when it is left unoccupied. An interior and exterior perimeter check is a good idea.

(3) Install a generator for the sump pump and other necessary appliances for potential power outages

(4) Keep eavestroughs clean & install downspouts to direct water away from the foundation

5) Have wood stoves/fireplaces & chimneys checked and cleaned by a WETT certified contractor annually

6) Drain your pipes and water system when you are going to be away from the cottage for more than a few days during the heating season. If your heat source fails you, your pipes will freeze and split causing thousands of dollars in uninsured damage to your cottage.

Whenever I am asked to give one good piece of advice I always tell people, “Talk to your broker, be honest, and don’t leave anything out. As a broker, I can’t help you if I don’t have all the information.” Insurance brokers can find the best company to fit your insurance needs, and explain the coverages, exclusions, and conditions of your policy.

Thank you to Lori McCormack and the brokers at AW Shier Insurance and Stan Darling Insurance for their contributions to this article.

Stan Darling Insurance has offices in Sundridge & Burk’s Falls and affiliates in Bracebridge & Gravenhurst : www.standarlinginsurance.com

Sundridge Office: 1-800-267-8427 or 705-384-5361

Burk’s Falls Office: 1-800-267-1904 or 705-382-2902 AW Shier Insurance Brokers www.awshier.com

Bracebridge Office: 1-800-387-4437 or 705-645-8701 Gidley & Associates Insurance Brokers www.gidleyinsurance.com

Gravenhurst Office: 1-888-572-1996 or 705-687-7233

Lesley-Anne Goodfellow

Lesley-Anne Goodfellow